It also offers tax services that must be bundled with bookkeeping services and CFO services. It provides bookkeeping services in QuickBooks, making Pilot accessible to many businesses using QuickBooks. Also, Pilot’s chief financial officer (CFO) services are ideal for businesses that want to scale strategically and gain expert business insights. Pilot also has catch-up bookkeeping but pricing isn’t disclosed on its website. It’s the reason we’re one of those most popular small business invoicing software – having been used by over 30 million people worldwide. During a trial, small business owners get access to all FreshBooks features except Advanced Payments (like FreshBooks invoicing, time tracking, and expensing).

Add Value and Grow Your Business, Become a Partner

It’s a great option if you’re looking for reliable and efficient support year-round. Scrambling at the last second to gather documents for tax season is stressful, and rushing bookkeeping-related tasks can make you vulnerable to compliance issues and missed growth opportunities. Thankfully, online bookkeeping services have lowered the financial barrier to getting bookkeeping and tax-related help. In more traditional bookkeeping services, it was more of a process to get reports out. Someone had to be there to run the report, save it in the right format and send it out.

Bookkeeper360: Best for hourly bookkeeping

The platforms on this list can help you streamline the process of tracking your expenses and revenue, reduce manual errors and understand the financial health of your business at a glance. These tools are indispensable to helping a small business grow, and with our firsthand insights and guidance below, you’ll be able to easily select the best accounting software for your needs and your budget. However, it could be FreshBooks’ small size that allows it to provide the outstanding customer service for which it’s known. The reason we give Xero an overall lower score than Zoho Books and QuickBooks Online is its lackluster mobile app and the absence of any form of live customer support. The Xero mobile app is missing some basic features like receiving customer payments, recording time worked, and viewing reports.

Next up in Business

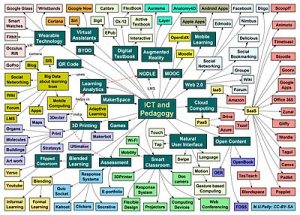

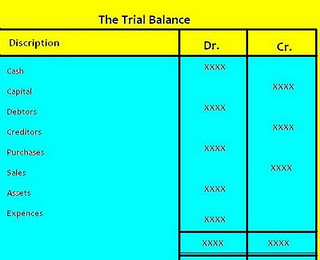

The course requires students to assess risk response by identifying and evaluating tests of controls and substantive procedures. In addition, the course will have students evaluate risk response using data analytics and audit sampling for substantive tests. The prerequisites to this course are Intermediate Accounting I, II, and III, Accounting Information Systems, and Business Law for Accountants. Cost and Managerial Accounting focuses on the https://www.quick-bookkeeping.net/ concepts and procedures needed to identify, collect, and interpret accounting data for management control and decision-making. Topics covered include budgeting, cost-volume-profit analysis, job costing, process costing, activity-based costing, standard costing, and differential analysis. You may handle payroll functions as a bookkeeper, keep tax withholding records, and issue paychecks or send information to a contracted payroll service.

- If you don’t want to manually enter transactions into Wave, you can opt for the Pro plan to link an unlimited number of bank and credit card accounts for automated reconciliation.

- You don’t have to log in to classes at a certain time—you are truly in the driver’s seat of your education.

- The first part of the course focuses on knowledge about organizations and how people operate within organizations, including the areas of organizational theory, structure, and effectiveness.

- Accounting software helps you track how money moves in and out of your small business.

- We also utilized information from our partners to enhance our understanding of what a good online bookkeeping service provider should be.

What is the best accounting software for small businesses?

It offers catch-up bookkeeping for businesses with delayed bookkeeping for more than two years. Live Expert Assisted doesn’t include cleanup of your books or a dedicated bookkeeper reconciling your accounts and maintaining your books for you. Live Expert Assisted also doesn’t include any financial https://www.accountingcoaching.online/in-bookkeeping-why-are-revenues-credits/ advisory services, tax advice, facilitating the filing of income or sales tax returns, creating or sending 1099s, or management of payroll. QuickBooks Live Bookkeeping offers online bookkeeping services that connect small businesses with trusted, QuickBooks-certified virtual bookkeepers.

QuickBooks Live is our top pick for online bookkeeping services because it offers cleanup bookkeeping services that vary based on your company’s needs for your first month. This service is ideal for business owners who want to get their bookkeeping in order but don’t have the time or resources to do it themselves. FreshBooks’ online bookkeeping services help you protect your profits, save you time, and grow your business. In collaboration with Bench (more on them later), we offer expert virtual bookkeeping systems and tax services support. The two platforms work together seamlessly, allowing you to effortlessly bill and invoice with FreshBooks, and automatically see that income reflected in your bookkeeping.

In most cases, once you click “apply now”, you will be redirected to the issuer’s website where you may review the terms and conditions of the product before proceeding. Invite your accountant and their team of up to 10 accountant team members to your FreshBooks account with just a few clicks. Your accountant will be able to update your Journal Entries and Chart of Accounts. 14 things you should know about time deposits in the philippines Plus, they can run reports, file taxes, and help you make smart business decisions. Nearly 70% of business owners who have been there, done that, recommend writing a business plan before you start a business. Plus, if you prefer to manage your business on the go with a mobile device, you can download the FreshBooks mobile app – and handle your accounting from anywhere.

The next two most popular accounting software are Sage 50 with 10% and Xero with 9%. Implementing new accounting software can be a major project—even for a company with only a handful of employees. Before buying your software, talk with your current software users about what they see as the most important features. Make note of what processes are currently being done by hand or in spreadsheets that might be easier in a new accounting platform. We evaluated the best small business accounting software using our internal case study. For instance, its project accounting feature doesn’t allow you to compare estimated and actual inventory used, which is also the weakness we found in QuickBooks Online.

Via QuickBooks Payments, which is included free (apart from industry-standard transaction fees) with each plan, users can also configure invoices to accept online bank transfers and credit card payments. Accounting software is used to extract data from large tax documents, create new journal entries, track payments, send invoices, and eliminate manual data entry. Automation can provide enormous time savings for finance departments that total thousands of hours annually, which is another reason to consider implementing accounting software. Cloud computing revolutionized the accounting software space, offering users access to their data from any internet-connected device from any location. The ability to connect your accounting software to other business programs you use saves you valuable time because you don’t have to manually transfer data from one system to another. Integration with systems you already use also cuts down on training time for employees who will use the software.

Bookkeeping services are available on the Enterprise plan with costs $375/month. We picked Pilot for startups because it provides a $200 monthly discount for prerevenue startups. The Pilot team also has professionals who are experts in helping startups scale up and grow. If you’re a startup, we highly recommend Pilot for its expertise and experience in handling startups.

Or reap the rewards of our Affiliate and Referral programs – look no further for your next growth opportunity. Get more time for your business and clients, and even a little extra to plan for the future. Keep your books in check, your clients happy, and deliver the work you love doing. If you’re several years behind on your bookkeeping and taxes, you can get caught up and filed with Catch Up Bookkeeping. No matter how far behind you are (yes, even years behind), we can get you caught up quickly. If you’re switching from QuickBooks, we’ll work from your closing balances to do your bookkeeping going forward.